There is an opinion: why don’t people pay for autosigma?

Loan secured vehicle sweeping the country: is it worth it to fear?

Autosim, he is a loan secured by the vehicle, as it is known has a number of advantages for car owners: fast execution, immediate delivery of funds. No wonder this type of lending is becoming more popular across the country. But to approach this kind of economic services to the mind, otherwise not long the hour when avtolombard or the Bank giving the loan on the security of the car, this very car will be auctioned, leaving enterprising, but unlucky motorist with no means to move.

Alas, originated in the 50-ies of XX century in USA the direction of modern usury now feels great in Russia. According to the Central Bank for the first 8 months of this year, the service of loans (including car loans) has become more popular more than 14%. With the increasing number of borrowers grows and the percentage of defaulters. Moreover, according to the company CarMoney – service autosigma – computed not only the owners of budget brands, but also those who seemingly knows how to count money – wealthy people who own premium brands.

Kia, Hyundai, Ford, Mercedes-Benz and BMW – the owners of these car brands according to the service avtosib “CarMoney” most of the time does not pay rates on granted funds. By the way, according to the spring study was conducted in the same year, the owners of Hyundai, Kia and Mercedes most often put in their cars to bail out the available funds in the business (most often) or for other purposes. There is therefore nothing surprising in the fact that, of the total large mass of borrowers is the larger percentage of defaulters.

In some regions the delay on autosigma above?

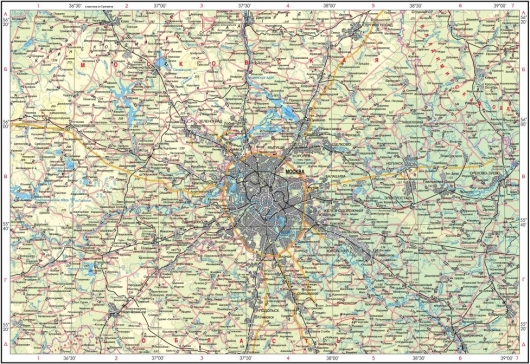

Also interesting is the fact that delay payments on loans are not the poorest or problematic in terms of economic development regions, on the contrary – the problem is spreading at large cities, including Federal: Moscow, Saint Petersburg, Krasnodar, Rostov-on-don, Chelyabinsk… Here are the cities included in the ranking study considered sixty regions of Russia.

As it turns out, in a big city the owners don’t care about their cars and are willing to part with them with a light heart? Judging by the fact that among the defaulters is observed a considerable number of motorists in the premium cars: delayed payment of every third owner of a Jaguar, every fourth owner of a Porsche, and every fifth owner of Audi (data from similar studies for 2017), it is indeed possible to assume that in the major cities of the country the car has long ceased to be some kind of a status thing and people are willing to part with one “iron horse” for the sake of a quick profit, knowing full well that they can afford to buy a similar car in the future (because they take money that is in circulation, not a gift to his wife). Or they just have no way out? Hmm, the question is actually complex and it analysts not directly responsible.

Analysts also noted that the failure to extinguish the loan even owners of cars UAZ and KAMAZ, every fifth and every third, respectively.

The ratio of total number of loans secured by a car or overdue payments on them in 2018, a negative rating was headed by the southern, North-Western and Urals Federal district.

In the analytical study, there is a ranking of the most punctual payers. In 2018 they were owners of Opel, Toyota and Mitsubishi. A year earlier, the rating was headed by the owners of Skoda, Suzuki and Italian Fiat.

So, summing up your own summary of the above published data is to advise the following: no serious need should not get into this game, if you can’t imagine life without a car. Yes, convenient, Yes, but who can guarantee that you have enough funds later to buy your own car from the collateral captivity? Statistics will not lie…