The cost of the policy CTP in the country increased, we felt it myself

We have estimated the cost of insurance for your car and gasped!

From 9 January 2019 has expanded the so-called tariff corridor for the insurance policy. In addition to its increase in both directions, from 2746 to 4942 rubles, while earlier taken part in 3234 and 4118 rubles, respectively, was introduced 54 the additional factor, increasing the total to 58, including including also lowering the value. But as far as a good cause work in reality? Why car insurers are in no hurry to reduce the cost of your insurance product? There are several reasons that we will reveal later on, but for now let’s conduct an experiment.

Calculate for yourself the cost of the policy CTP

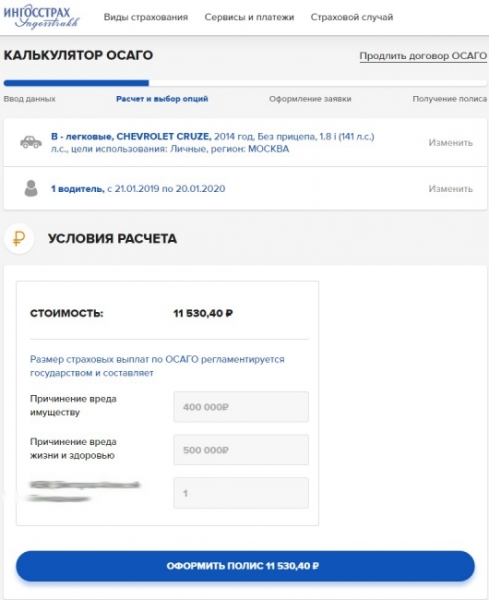

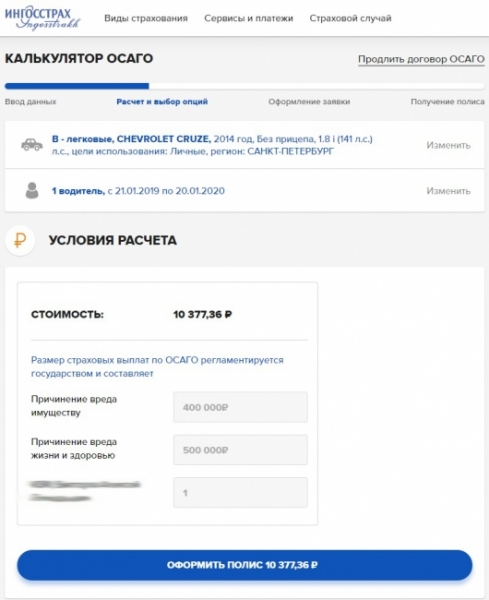

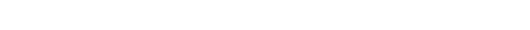

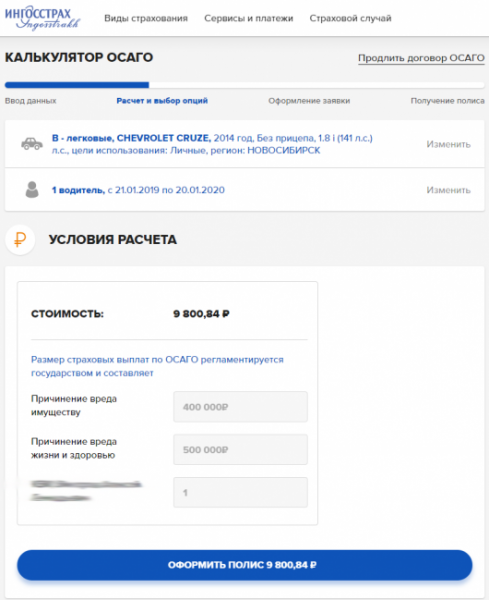

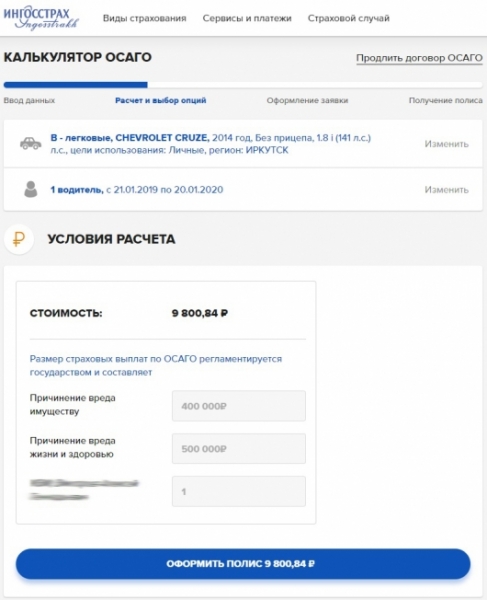

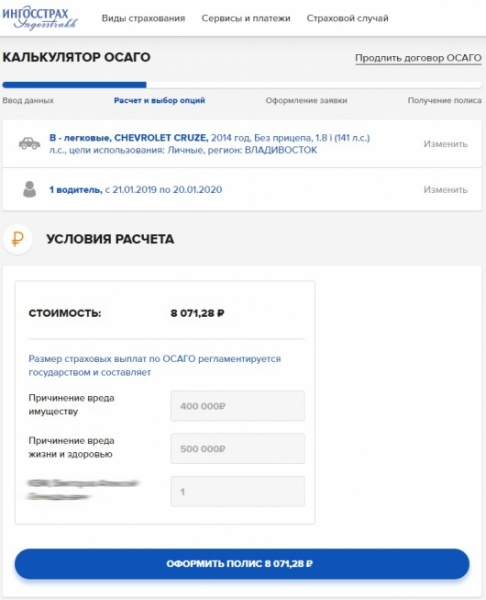

Let’s examine the cost of CTP on the new tariffs for the average driver of the car, calculate the cost of the policy for an individual, hypothetically, living in 7 different cities of Russia.

People will be inscribed in the insurance coverage individually. He is 30, and as an experiment, he will move to the Chevrolet Cruze 2014 model year with a 1.8 engine with power of 141 HP without open rights categories BE enabling to manage a car with a heavy trailer weighing more than 750 kg and a car used for personal purposes. As for experience of management, he is 11 years 8 months.

Calculations carried out on policy with a regular annual contract. No “seasonal usage” (when the driver in certain months of the year does not use her car) and other discount marketing gimmicks will not use.

*Oh well, I guess the times when I paid 8 thousand gone.

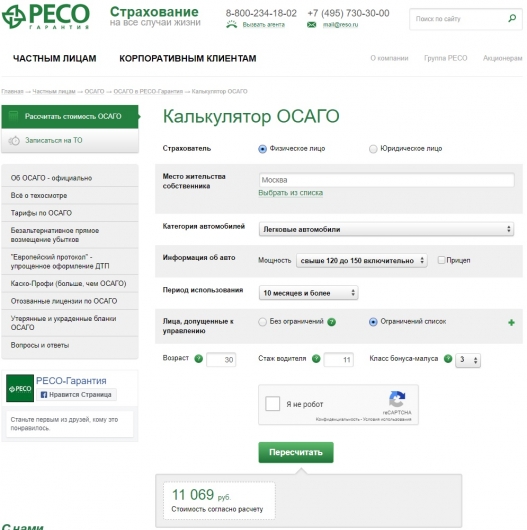

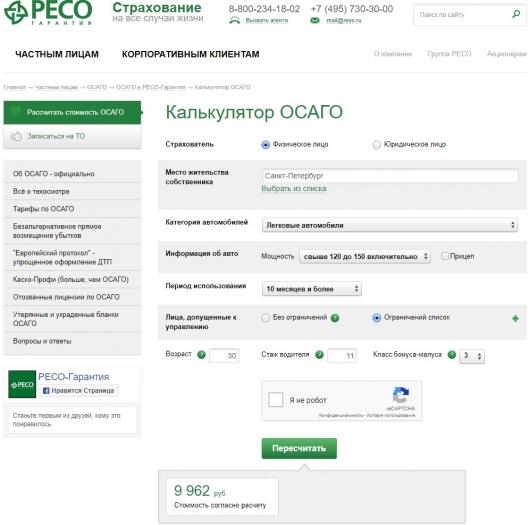

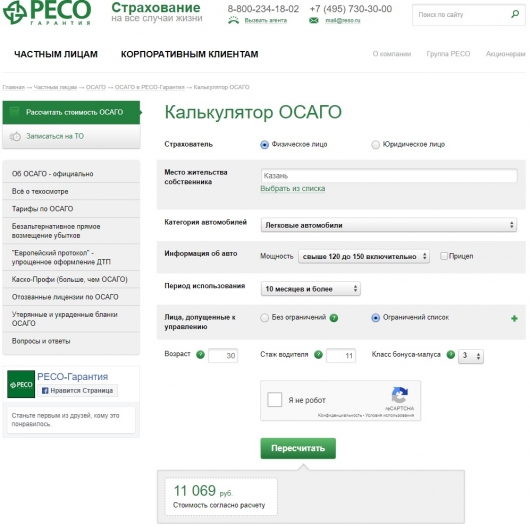

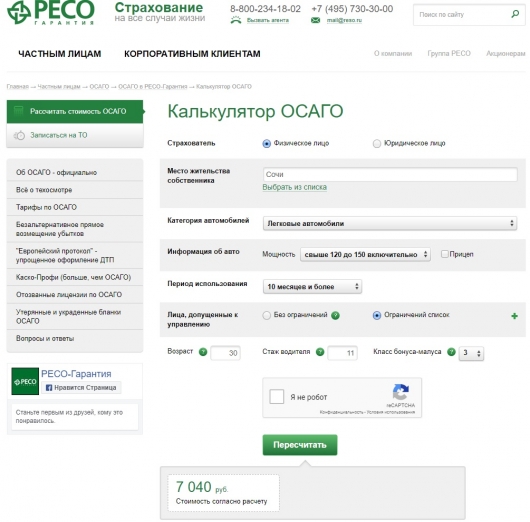

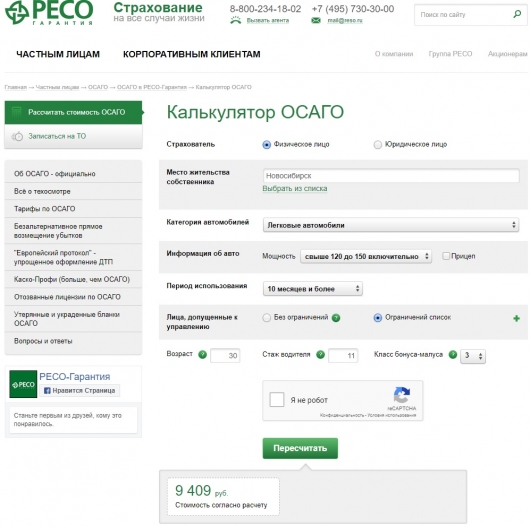

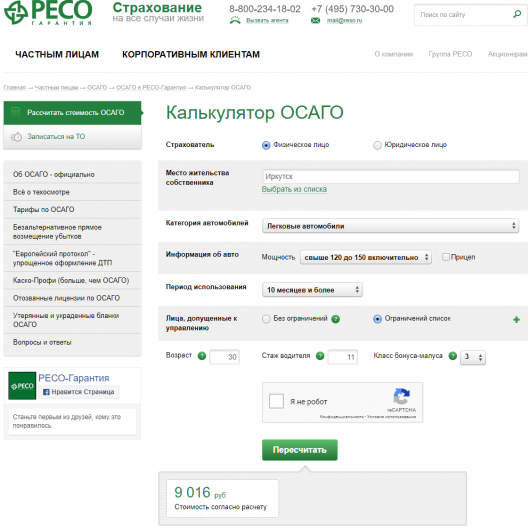

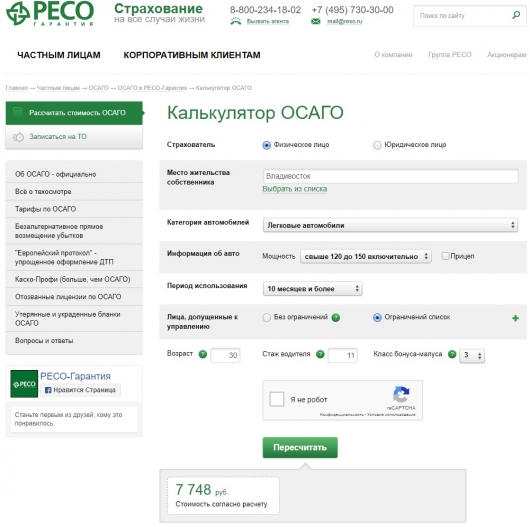

The following example calculations calculator insurance “RESO-Guarantee”.

The company “RESO-Guarantee”

The source data are the same.

Why is it so expensive?

As seen in the comparison of two large Russian insurance companies, the cost between the products they have when given the same input data, different, though not seriously, but graduation rates between different cities of the country is sometimes enormous!

This is due primarily to the corridor of the base fare (from 2.746 to 4.942 rubles) and prices are individually adjusted by the insurers for each of the regions of the country.

And here it becomes interesting, because as seen in the example represented cities, insurers set a base rate on their own and as you can see, the difference can reach up to 4 thousand rubles and above (for example Moscow 11.530 rubles Sochi in which the policy is exactly the same driver with the same age and driving experience would cost much cheaper 6.918 rubles).

How so? Very simply, it all depends on the loss of a region for insurance companies, which is governed by the so-called territorial coefficient. For example, are operating in the city and the region, the insurance fraud, the insurers suffer losses, so will raise the bar in the hallway to the ceiling and will insurance cost there are far more than the average for the country and endure will have the car owners.

There is simply unprofitable from the point of view of insurance regions. I they machine more payments have to be made more often. Instead of profits minus (at least write so in the report). Conclusion, it is necessary again to raise the tariff to the maximum.

And if the big players such conditions, though unpleasant, but tolerable (fraud, loss), for small insurance companies there is little choice, the tariff rate for insurance in troubled cities will be extended to the maximum. Thus, according to the “RG”: “the national average price of insurance has risen from 5916 6189 to rubles“.

Personal opinion after calculations (I want to Sochi!)

After approximate calculations, published above, because in my life I really am a customer of “INGOSSTRAKH”, I was filled with fear. In three months I will probably have to pay 3,000 rubles morethan last year. FOR WHAT??!!! I’m insurance keep to the rules, the accident did not hit it (ugh, ugh, ugh), fines a little insurance with a limit. But I, like millions of other motorists pre-recorded offenders, dangerous drivers and someone else there. Here is the liberalization of tariffs, here is the extension of the corridor in both directions. Something all one-sided again it worked from them.

All move to live in Sochi, where the insurance is cheaper! Solved!

P. S. Although I complain? We knew what will lead to “the extension of all these corridors,” wrote about this, read here:

As due to problems in one insurance company we want to make to pay more for insurance policies

But for someone more expensive and cheaper insurance policy

The insurance policy could rise by 40% in a few years

So what you want, do not want, and have to take out a policy for the amount of money for which you give it. And don’t listen to a view that competition will force the company to reduce prices or fear of customer churn on the black market “insurance”. Sure, the actual reduction of tariffs in the foreseeable future. At least not yet. And maybe even… ever.

Sometimesiamanasshole знатьЗаконодательствоТехосмотрЛайфхак

Knowledge base