As the drivers are massively deceived in the fake electronic insurance policies

Caution: in the market intensified fraudsters selling policies E-insurance.

Unfortunately, in our country, if something is easier, that the enterprising citizens who will figure out how to cash in not exactly legal way to trusting society. Here is a live example how the simplified order of purchase of electronic insurance policies has turned into a real Orgy in the insurance market, where, apparently, with the introduction of electronic insurance policies had resolved the problem with fake insurance compulsory third party liability insurance. But no. We live in Russia, where the descendants of Ostap Bender instantly able to come up with a thousand and one ways to take money from unsuspecting citizens.

Now, recall that recently appeared in Russia the ability to remotely purchase on the Internet electronic insurance policy (called a policy, E-insurance). Under current law drivers possible not to have the insurance policy on paper, but rather to have a printout of the policy purchased electronically through a special system developed by the Russian Union of insurers, is connected to all insurance companies that sell insurance policies.

From the beginning the service for the purchase of electronic insurance policies started to gain popularity. The share of insurance sales through the Internet continues to grow exponentially. In the end, even the insurance companies themselves (especially their branches and brokers) were more likely to make car owners and drivers electronic titles, printing them on ordinary black-and-white printer.

We will remind that now the traffic police are not entitled to claim from the drivers insurance policies issued on the original form. Now the traffic police-you may only submit a printout of the e-policy, E-insurance, unless the insurance contract you entered into via the Internet. If you have purchased the insurance policy on paper then, of course, provide the DPS required original form.

Unfortunately, simplifying the procedure of buying insurance policy over the Internet, our government not only did not get rid of scammers in the market of compulsory third party liability insurance, but is much simplified cyber criminals and unscrupulous insurance agents way of making a fool unsuspecting drivers. In General, insurance policies came out as always wanted as better, it turned out even worse. After all, remember that e-insurance policies were introduced in the first place, to get rid of fake and invalid forms of insurance. Electronic insurance policies helped to solve problems in many regions, where insurance companies in various ways did not want to sell policies without additional services.

So, here as often today, there are unscrupulous insurance agents, brokers, and outright frauds.

When you do not directly pay to the insurance company for execution of insurance policy, typically in the role of the intermediary are various insurance agents or brokers for the insurance, get insurance from insurance companies reward.

But some agents, apparently, this was not enough. So, let’s imagine that you have come to the dubious intermediary that sits in the booth near any of the traffic police, with the aim of acquiring insurance policy. In the end, you are promised with a good discount to sell the insurance policy.

Next, you report that the original forms of insurance has expired, so you will be issued the e-policy, E-insurance, which will be printed on a normal printer. Of course, you know that such a policy is suitable to control the car, and therefore agree. Especially sweet you think the price tag announced by the agent.

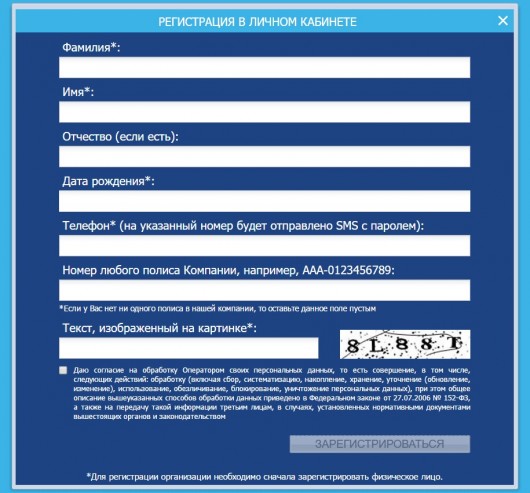

Then the insurance agent using your computer connected to the Internet, goes to a special online service of any insurance company where it is possible to buy e-policy, E-insurance, and prepares insurance first.

At the time of placing the insurance on the website of the insurance company the scammer enters false data about vehicles and drivers entered in the insurance policy. For example, very often instead of a car when placing a policy unscrupulous agent specifies a motorcycle.

The purpose of such invalid data is maximum understatement of the insurance premium.

After making a cheap policy graphic image Blanca E-CTP is transferred by an attacker in Photoshop or any other graphic editor, where in b/W form E-insurance changes about your car, about your rights and about other drivers admitted to driving the vehicle. In the end, you get fake electronic form of insurance policy, paying fraud the full amount of the insurance policy CTP. A dishonest broker puts and pocket the difference. You understand that in a passage or travel location (e.g., at the Department of traffic police) a cheater thus can collect a decent amount.

Including such fraud with electronic policies occur massively and the Internet, where fraudsters lure is unsuspecting motorists, pecking at unrealistically cheap price tag on the insurance policies. Even funny, when the Network is found advertising the sale of insurance policies at prices below the base rates set by the Central Bank. The worst thing is that drivers who fall for such a divorce, is becoming more and more. You know that in our country those who like freebies galore.

Unfortunately, the purchase of such Neopolis may result in insurers with big challenges. The fact is that according to the current legislation if the insurance company received a partial insurance premium in case of receipt in electronic form of inaccurate data, upon occurrence of the insured event, the insurance company will not pay caused by accident damage. That is, in fact, buying this fake policy issued a fraud on unreliable data, you get a regular piece of paper, which protects you from traffic police. In fact, you are, in fact, driving without insurance policy, insuring your civil liability. As a result, if through your fault there is an accident, the damages you will have to pay out of pocket.

Fortunately, the Central Bank of Russia decided to tighten the process of acquiring electronic policies E-insurance, banning insurance companies to issue e-insurance policies brokers. Recently, the Central Bank of the Russian Federation has sent to the insurance companies instructions to issue the electronic policies only to owners of vehicles or drivers who will be entered in the insurance policy.

Many may think that such a ban on the issue of insurance policies intermediaries violates the law and human rights. But it’s not. For example, the insurance companies suggest to refuse intermediaries in the design of electronic insurance policy, referring to article 929 of the civil code, which States that the policyholder chooses to purchase insurance, must have a property interest in the contract of insurance.

So in a short time the number of counterfeit policies E-insurance should go down. But to rejoice still early. You know what country we live in. Because at one tightening, as always, will quickly find several ways to bypass it. I hope that this time unscrupulous insurance agents and brokers will not be able to figure out how to circumvent the system of purchase of electronic insurance policies with the purpose of cheating drivers.

Sometimesiamanasshole знатьЗаконодательствоТехосмотрЛайфхак

Knowledge base